What Happens if Your Car Insurance is Canceled for Things To Know Before You Buy

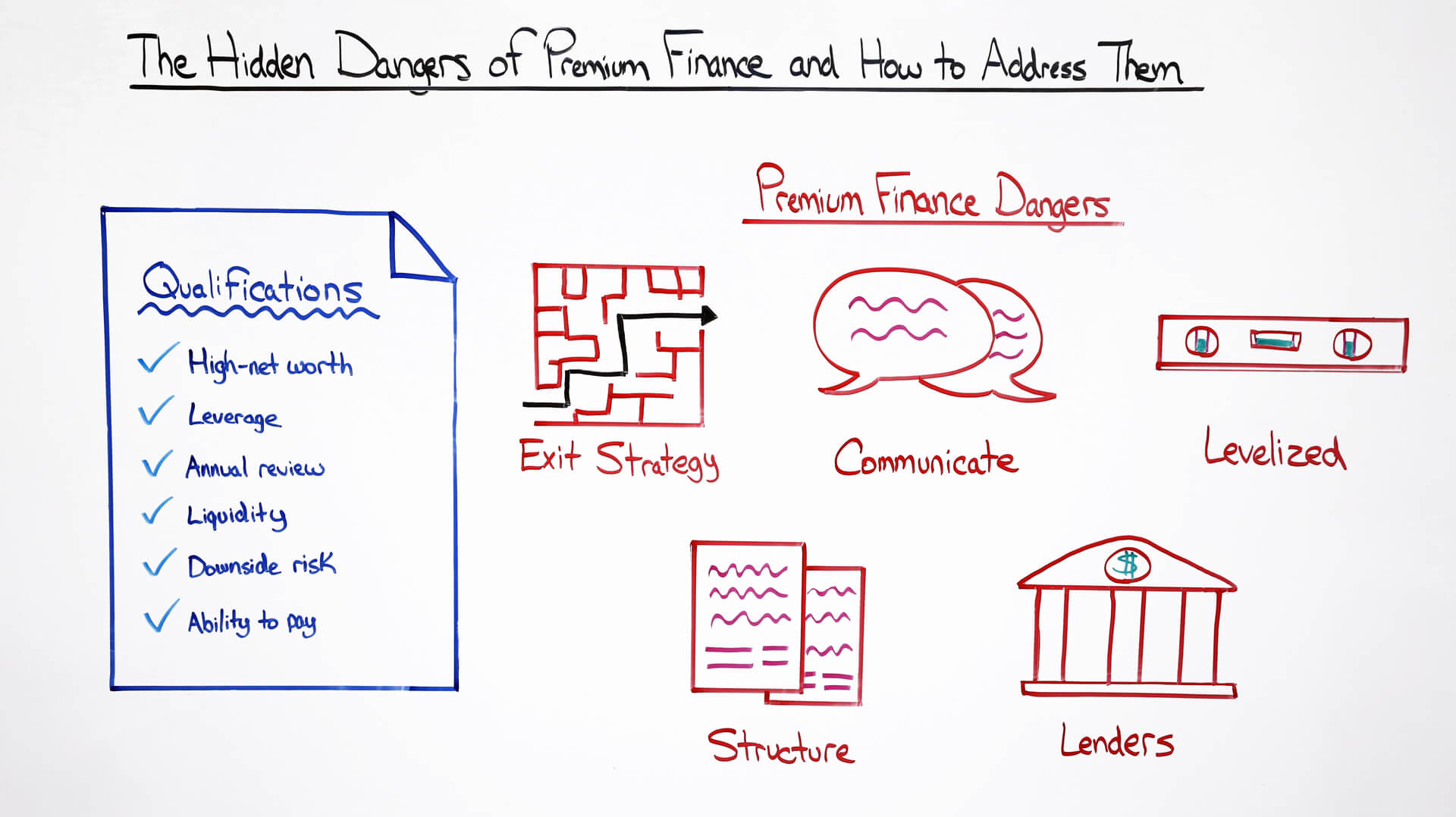

2021 Ultimate Guide to Premium Financed Life Insurance - Banking Truths

The Best Guide To What No One Tells You about Financing Life Insurance

Factors to Exchange an Existing Policy? There are Click Here For Additional Info that a life insurance coverage policyholder might wish to change an existing policy with a new life insurance coverage policy. For instance, Enhanced health or mortality improvements across the basic population may result in insurance coverage at a lower cost. You might have interest in the solvency of the insurance provider that released the original policy or with the service of the representative that offered you the policy.

Reasons Not to Exchange an Existing Policy There are likewise numerous reasons why replacement of an existing insurance coverage policy may not be a good idea. For instance, Money value constructed up in the initial policy may be used to the new life insurance policy's first year expenditures, consisting of commissions. Life insurance coverage policies (aside from term policies) typically include early surrender charges, which can lower the amount of money value offered towards the brand-new policy.

2021 Ultimate Guide to Premium Financed Life Insurance - Banking Truths

You might pay higher premiums if, for example, your health has declined given that the purchase of the current policy. The new policy generally will have a brand-new contestability period - a two-year duration from the issuance of the new policy throughout which the insurance provider could challenge a death claim based upon a misstatement on the application.

2021 Ultimate Guide to Premium Financed Life Insurance - Banking Truths

What You Must View For You ought to exchange your life insurance policy only when you figure out, after knowing all of the realities that the exchange is better for you and not just better for the individual who is attempting to offer the policy to you. Both variable life insurance coverage and variable universal life insurance coverage are securities.

Sun Life Assurance Coof Canada vImperial Premium Finance Fundamentals Explained

This implies that a broker should inform you the important facts about the advantages and disadvantages of the exchange. Your broker or insurance coverage agent should advise such an exchange just if it remains in your best interest and only after assessing your personal and monetary situation and needs, tolerance for risk and the financial capability to pay for the proposed insurance coverage.

This activity is normally called "financing" premiums. It might not be proper for you. For instance, withdrawals from existing policies might undergo federal earnings tax and may decrease the survivor benefit. Obtaining money from an existing policy will likely decrease the death benefit. Withdrawals or loans might make it harder to keep the initial policy in force without extra out-of-pocket premium payments.